How ticketing platforms simplify the shopping experience (pt. 1)

This is the first installment in a two-part piece on how ticketing platforms reduce The Paradox of Choice and help users find the perfect seats for them. If you’ve already read this article, then continue on to part 2 (coming soon).

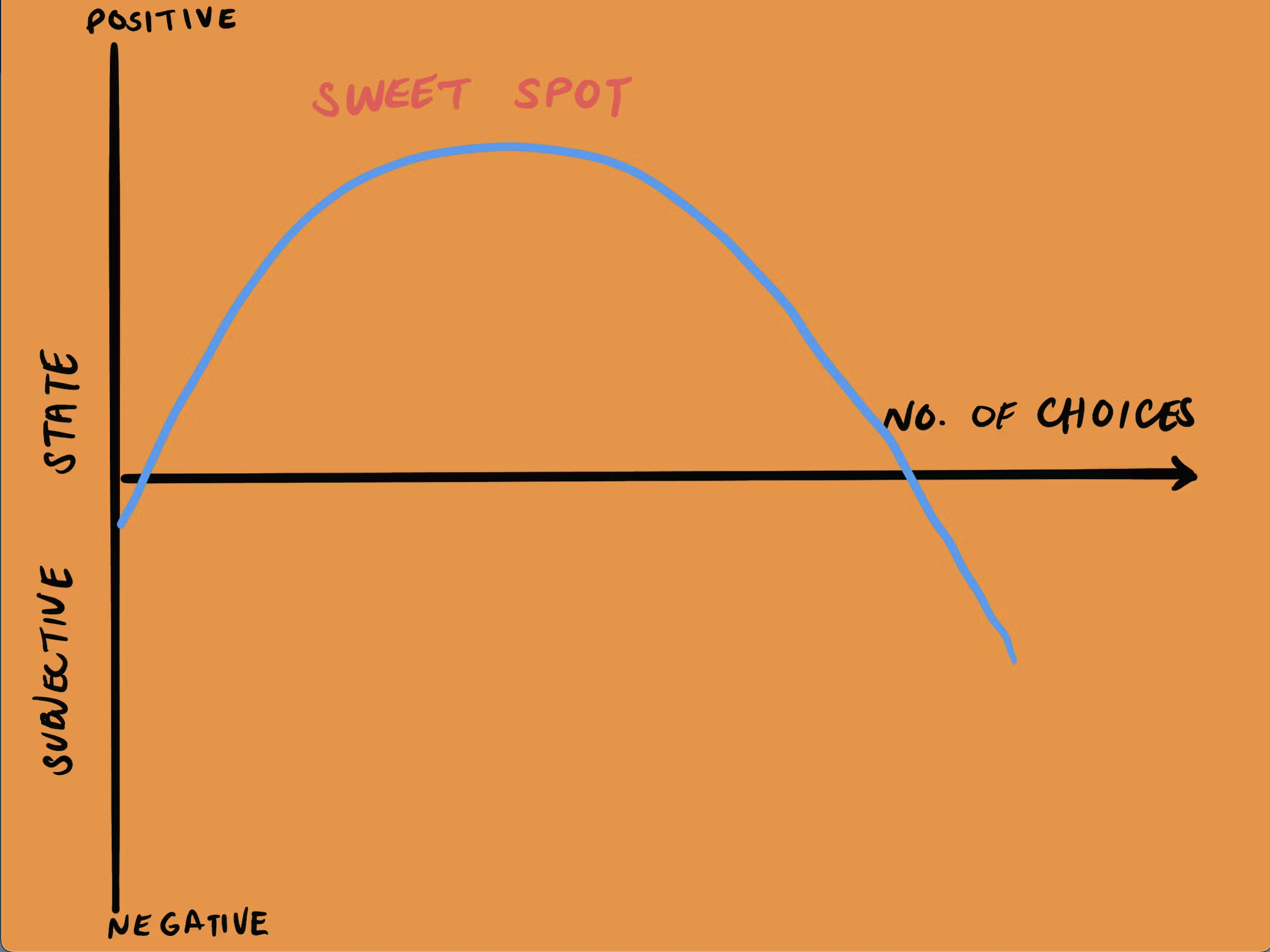

In his book, The Paradox of Choice, author and psychologist, Barry Schwartz, explores how having too many choices can lead to anxiety, dissatisfaction, and decision paralysis. Schwartz argues that while freedom of choice is generally seen as a good thing, an overabundance of options can actually make us less happy.

Overcoming the Paradox of Choice is an important challenge that many digital experiences have to navigate, particularly in e-commerce, reservations, and ticketing. Type “kitchen knife set” into your Amazon search bar and the e-commerce giant will fetch over 30,000 product options for you to peruse. Even in a digital setting, seeing 30,000 options simultaneously presented would be overwhelming to say the least, so Amazon limits the visible results to just the top 50 or so. But imagine if the same breadth of options were available in your local kitchen supply store; you’d be more likely to leave having purchased nothing than having bought something you feel good about.

Ticketing products must address the very same issue. Major indoor arenas in the US have roughly 20,000 seat capacities, a similar figure to those offered by most outdoor baseball and soccer stadiums around the country. Football stadiums, boast even greater capacities, often 3-5 times larger than their aforementioned counterparts, with the University of Michigan’s “Big House” topping off at over 107,000. With potentially hundreds of these venues in use on any given day, fans have millions of tickets options available to them when they shop for live entertainment.

With all those seats available, each one a potentially attractive option in a sea of choices, how do ticketing platforms make this decision easier for the rabid fans hoping to find the perfect seat for them?

There are layers to this answer, the beginnings of which originate long before the user begins to search for their ideal ticket. A review of the top ticketing platforms in the industry reveals that while each handles this process a bit differently, there are 5 key things these products do to bring simplicity and ease to a decision complicated by an overwhelming breadth of choice.

Onboarding: Learn about the user’s demographics, interests, and preferences right away to begin constructing their taste profile

Discovery: Curate the most visible events to match the user’s taste profile within their geographic location

Offerings: Reduce the universe of available options to a sampling of just the “best” ones

Presentation: Clearly communicate the the objective merits of the offered options, along with how they differ from one another

We’ll cover the first two of these in this article, and the final two another time (you can read that entry here: coming soon).

Helping users find the right tickets for them

Onboarding

For many ticketing products, the process of simplifying ticket selection begins in the first few seconds of the user’s experience on the platform. While there is certainly merit to minimizing onboarding friction, asking users to take a few extra seconds to identify their entertainment preferences can not only 20x the ease of ticket shopping, but also greatly improve the overall product experience by increasing the density of relevant content for each individual user.

Ticketmaster and StubHub guide new users through a multi-screen flow that identifies with increasing specificity the types of entertainment that the user has interest in. StubHub first asks the user if they are interested in Sports, Concerts, or Theater, the platform’s three entertainment verticals. Depending on the user’s selection, it then drills down further; for example, if Sports are chosen as the preferred category, it next asks about the leagues the user has interest in, followed then by the specific teams.

SeatGeek takes a lighter touch on this, choosing to instead give the user the option to curate their concert preferences by connecting their Apple Music (on iOS) or Spotify to their account (note: StubHub and other platforms also offer this integration, though not during onboarding). This gives the product arguably more insight into the user’s preferences than the self-reporting experience and allows the platform to stay up to date on the user’s tastes of the moment rather than from when they first created their account, potentially years in the past.

Of course, not all ticketing products choose to include preference setting as part of their user onboarding experience. GameTime, for example, takes a lower friction approach by advancing the user to the discovery screen immediately after they create their account. This reduces the Cognitive Friction that comes with having to make decisions about which sports, artists, or teams the user wants amplified within their app experience.

Products that bypass preference selection during onboarding can make up for it by learning about the user over time. Ticket purchases are among the most indicative actions a user can take for a product to passively learn their preferences, but search history, event views and other actions can also be plugged into a taste-making algorithm to accomplish the same task of curating the entertainment options the user is primarily presented.

The Hierarchy of Friction: Cognitive friction refers to any type of user friction that makes a process or task more complicated or mentally challenging than it needs to be.

Discovery

Typically located on the ticketing platform’s home screen, the event discovery experience is arguably the most important aspect of the ticket purchase flow. This is where the platform filters thousands of available events down to a small handful based on an assortment of factors and presents the personalized offering mix to the user. In addition to the factors discussed above - stated user preferences and user history - these platforms consider event popularity, ticket availability, and time sensitivity, in the algorithms guiding the content that appears, often prioritizing those that are trending or have limited seating. User demographics, such as age and interests, also influence the presented selections, ensuring that the events align with potential attendees’ tastes. Furthermore, local market insights help platforms tailor offerings to specific regions, enhancing engagement and satisfaction.

While differences between curation formulas among the ticketing platforms are to be expected, given the lack of transparency typical to backend algorithmic code, surprisingly we also find clear differentiation from the far more imitable UI/UX designs powering these product experiences.

A comparison of Discovery screens (left to right: SeatGeek, Gametime, StubHub)

The Discovery experiences of these platforms contain an aggregation of various widgets that present personalized recommendations of events, artists or teams, categories, and other content of interest to the user. The contents, look and feel, and position of these widgets is typically guided by continuous testing by the teams managing these platforms, which run dozens of experiments on a weekly basis to identify ways to further optimize the experience as measured by their guiding KPIs.

In a moment, we’ll take a look at some of the most common widgets found in these Discovery experiences. But first, a quick word on ticketing data. Most ticketing platform are powered by a data schema that essentially follows this top-down hierarchy:

Category: the type or genre of entertainment (e.g. Sports)

Sub-categories: levels of greater specificity to that type or genre of entertainment (e.g. Basketball - NBA)

Venue: the location of the event (e.g. Crypto.com Arena)

Artist or Team: the entity powering the event (e.g. Los Angeles Lakers)

Event: the individual event itself (e.g. Los Angeles Lakers vs. Los Angeles Timberwolves on February 28th, 2025)

Ticket: the end-user product (e.g. Section 101, Row 2, Seat 3)

With that in mind, let’s now take a look at the most commonly found widgets on Discovery experiences.

Featured event

Addressing the 5th level of the hierarchy, the single event (SeatGeek) or few events (Gametime) that the platform’s curation algorithm predicts the user will most likely show an interest in. The algorithm powering this widget likely looks at the user’s location and taste profile, the event’s timing (likely occurring in the next 48 hours), and the quality of the available tickets. Events that are close to selling out may be prioritized in this widget, as may events that are especially valuable to the platform’s business.

Trending (aka popular) events

Every ticketing platform has a version of this widget. Also operating on the 5th level of the hierarchy, these are imminent events occurring near the user’s location that other users are showing a lot of interest in. These events may have a lot of page views, or the tickets may be selling quickly. The idea is to leverage social proof - a thing’s popularity - and urgency to persuade users to consider these events.

Discounts on imminent tickets

Also typically operating at the event level, several of the major ticketing platforms present a version of this value-focused call to action (CTA). On StubHub, they are called “Last-minute deals”, on Ticketmaster it is simply called, “Ticket Deals”, and on Gametime, this is split into two widgets, “Events Under $50” and “This Weekend”. Regardless of what they are called, the concept is the same; a combination of value and urgency is a powerful purchasing motivator, and a helpful way to narrow a user’s focus.

Category selections

Unlike the previous three, this widget is powered by levels 1 or 2 in the hierarchy. Every major ticketing product presents some version of this widget, but interesting differences exist across the product landscape. SeatGeek encourages users to “Browse by category” while displaying its top-level categories of Sports, Concerts, Broadway Shows, Comedy, and Music Festivals. StubHub takes a different approach by instead curating a mixture of a top-level categories (Concerts), along with several sub-categories of Sports (MLB, NBA, and NFL), though this grouping may be different between users. Gametime takes a completely different approach by opting to treat categories in a way more akin to a filter by listing its top-level categories as a horizontal carousel near the top of the screen.

UI differences aside, the goal of this widget is the same: allow the user to filter down to the type of entertainment they are interested in to reduce the pool of options to only things that match their interests.

Teams or artists

Based on level 4, this widget is designed for the true fans in the user base - users whose purchasing decisions are largely driven by an interest in a specific entertainer, but not necessarily on an imminent day. Interestingly, this aspect of the data schema is presented in a far more diverse manner across the major platforms, and is worth dissecting a bit more closely.

On Stubhub, this category of widget is simply titled “Recommended For You” rather than mentioning the type of content within. Gametime splits this content between separate widgets, one for sports, called “Teams nearby” and one for music, called “Top Artists”. Ticketmaster is unique in that its entire Discovery experience is primarily driven by this type of widget, rather unlike the other platform that we have seen, which are more event-focused.

A comparison of Discovery screens (left to right: StubHub, Gametime, Ticketmaster)

The differences between these platforms are largely driven by the market positioning of the companies themselves. StubHub, the original peer-to-peer ticket reseller straddles the line between driving spontaneous purchases (event widgets) and planned purchases (team/artist widgets). Gametime, primarily positioned as a discounted, night-of ticket marketplace is much more focused on specific events and deals, than enticing fans to plan long term. Finally, Ticketmaster continues to dominate as the exclusive box office sales partner of many major concerts and sporting events, which enables it to focus on core fandom rather than spontaneous purchases by more casual entertainment seekers.

Featured venues and tickets

Discovery experiences addressing levels 3 and 6 in the hierarchy are far more rare, and often absent from the product all together. Their absence can be explained by the very narrow use cases for such an experience. Think about it, in what scenarios would you be driven to attend an event simply because it was taking place at a specific venue? While some extraordinary venues certainly can drive such behavior - for example, The Hollywood Bowl in Los Angeles, or Red Rocks Amphitheatre in Morrison, Colorado - most ticket seekers purchase decisions are driven by the above factors far more strongly than they are by the arena in which the event is taking place.

The Hollywood Bowl and Red Rocks Amphitheatre are amazing venues, but very few people would attend an event at either location unless the performer was meaningful to them

Even more rare would be the decision to attend any unspecified event simply because a particular seat is available. Certainly some unique cases exist where a user may be interested in a specific seat (Jack Nicholson’s Lakers tickets come to mind), but the use case is far to slim for these platforms to invest their value screen real estate on the off chance that the right user happens to come along.

Wrap up

Recalling the inverted triangle above, through just the first two out of five steps, we have reduced the complexity of the ticket purchasing decision from billions of options down to a few hundred or thousand (the available seats in a particular venue) by helping the user to identify the singular event that most interests them.

In part 2, we’ll examine the remaining two parts - offerings and presentation - of the product equation that these platforms put to work to now reduce the remaining options down to small handful between which the user can much more easily decide.